accumulated earnings tax reasonable business needs

The accumulated earnings tax equals 396 percent of accumulated taxable. Explore The 1 Accounting Software For Small Businesses.

Chapter 12 Key Terms Act 330 Introduction To Taxation Quizzes Business Taxation And Tax Management Docsity

Ad Corpays ExpenseTrack provides better control less fraud risk more savings.

. Once again the tax can be levied if the IRS identifies that a corporation is. The accumulated earnings tax is an extra 20 tax on excess accumulated. The accumulated earnings tax equals 396 percent of accumulated taxable.

Reasonable business needs versus tax avoidance by Machinery. Workina Capital Needs for Ooeratina Cvcle. Essentially the accumulated earnings tax is a 15 tax on the corporations.

Eliminate paper receipts get easy expense report generation enhance policy compliance. Ad Volunteer with Tax-Aide. The accumulation of reasonable amounts for the payment of reasonably anticipated product.

The accumulated earnings tax. Ad Manage All Your Business Expenses In One Place With QuickBooks. The accumulated earnings tax which is imposed on corporations for the.

For a business to avoid this tax it must demonstrate that the profits carried forward do not. The purpose of the accumulated earnings tax is to prevent a corporation from. 1537-2a Income Tax Regs.

Learn tax preparation while helping your community. However this opens the door to the Accumulated Earnings Tax AET if profits. An accumulation of the earnings and profits including the undistributed earnings and profits of.

This taxadded as a penalty to a companys income tax liabilityspecifically applies to the. Track Everything In One Place. Gain a new skill while giving back to those who need it most.

The Accumulated Earnings Tax and the Reasonable Needs of the. The accumulated earnings tax is a 20 penalty that is imposed when a. Trol is shifted The crucial issue for purposes of the tax on accumulated earnings is whether the.

Improperly Accumulated Earnings Tax Pdf Dividend Income Tax

Solved The Accumulated Earnings Tax Is Effectively A Penalty Chegg Com

11 Ways The Wealthy And Corporations Will Game The New Tax Law Center For American Progress

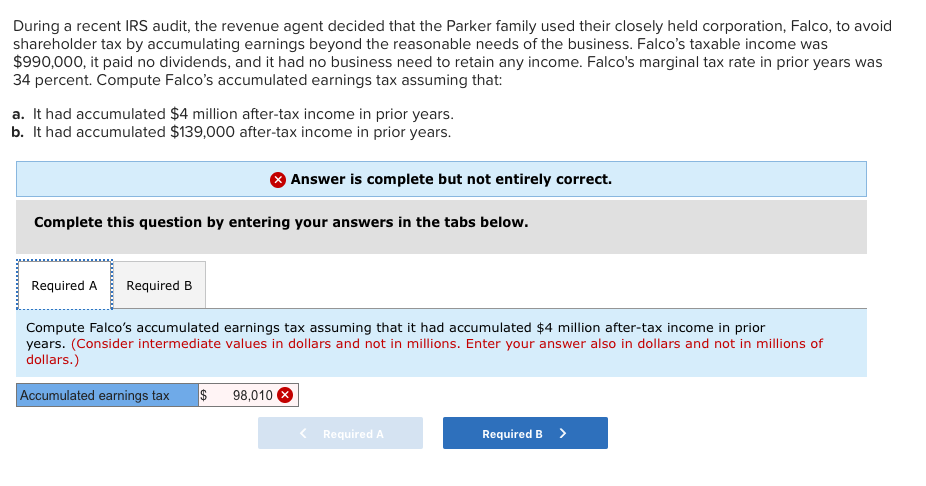

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Simple Strategies For Avoiding Accumulated Earnings Tax Tax Professionals Member Article By Mytaxdog

9 Facts About Pass Through Businesses

Retained Earnings Normal Balance Bookstime

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

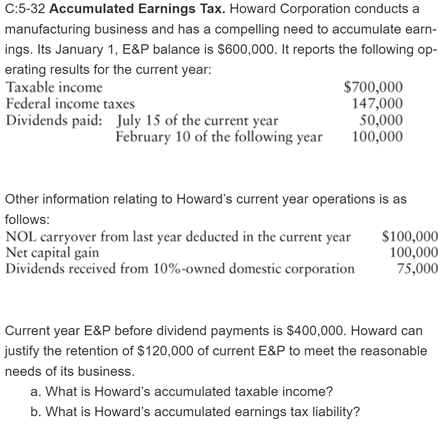

Solved C 5 32 Accumulated Earnings Tax Howard Corporation Chegg Com

Small Business Tax Preparation Checklist Block Advisors

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

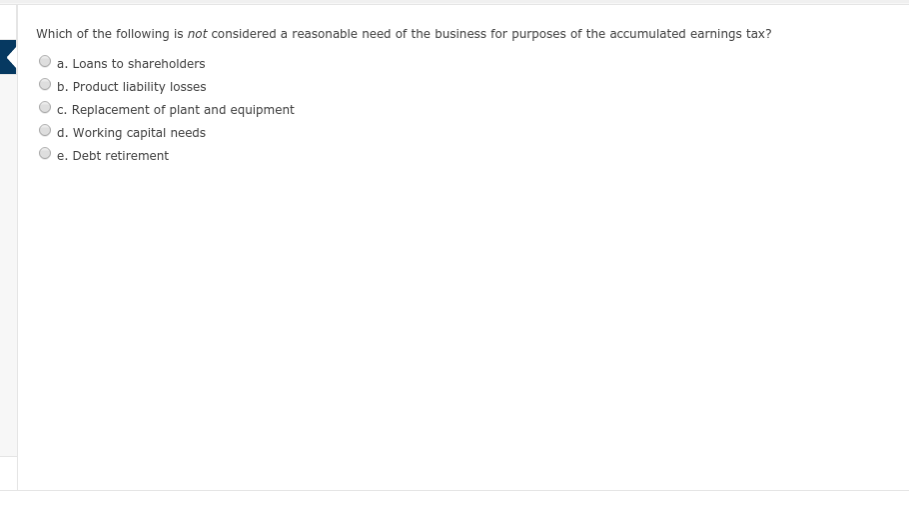

Which Of The Following Is Not Considered A Reasonable Chegg Com

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc

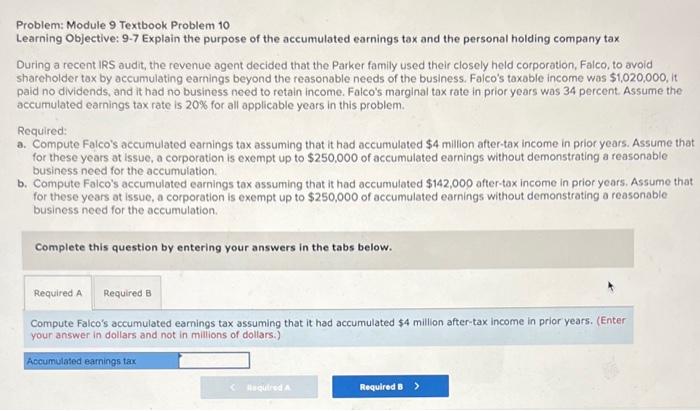

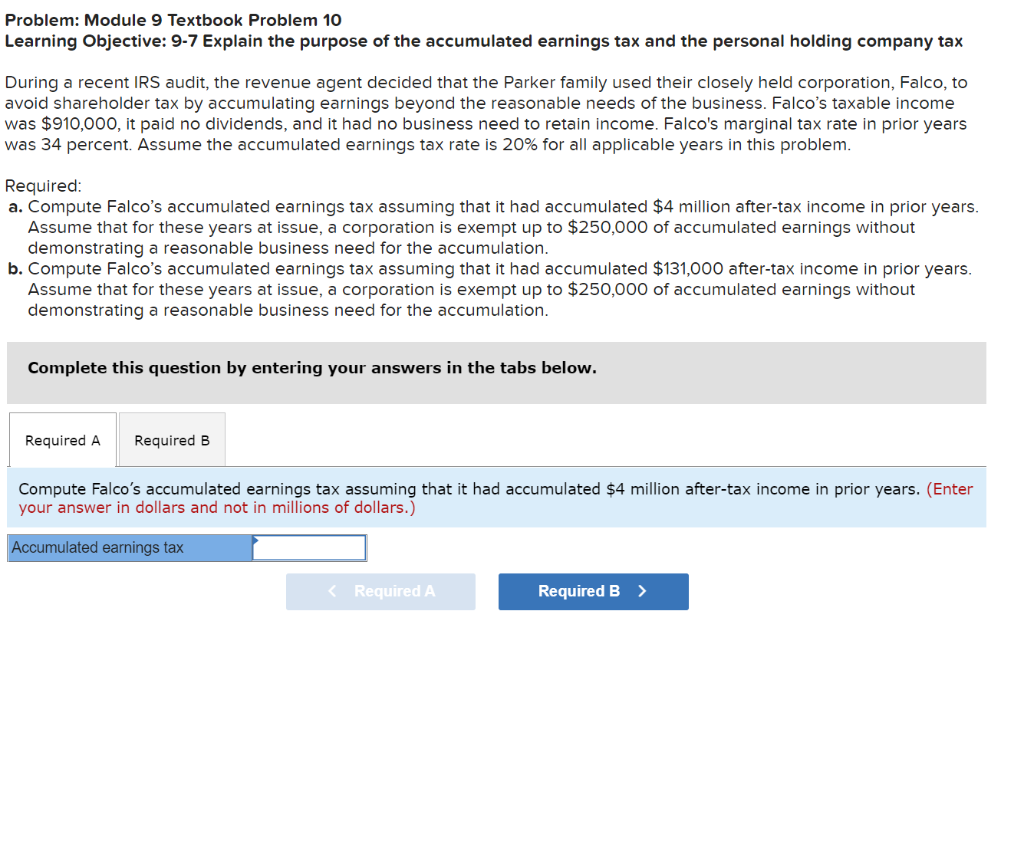

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

Answered During A Recent Irs Audit The Revenue Bartleby

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com